Government Contract Finance.

Credit Assurance can help you establish or extend net credit terms with your suppliers to fulfill your government Purchase Orders and service contracts.

TRADE CREDIT · WORKING CAPITAL

Credit Assurance coverage together with a receivable based credit line allows you to build business credit quickly by providing your suppliers with an assurance against payment default and have the ability to draw cash to pay your suppliers and your payrolls on time.

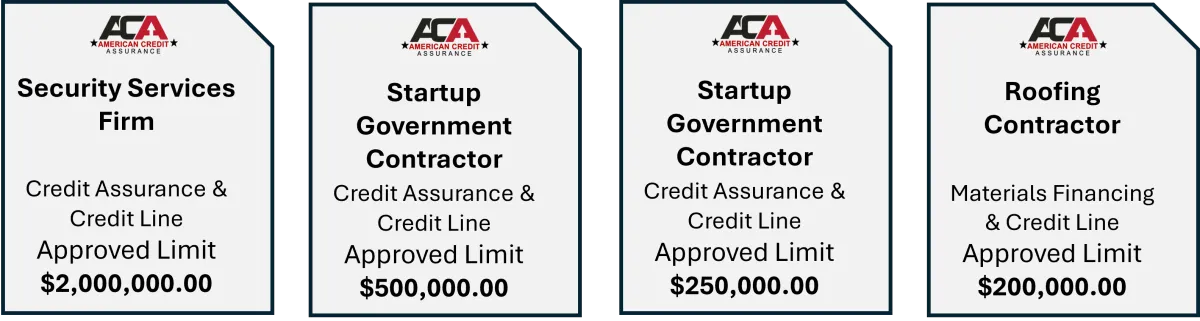

Recent Contract Financing Approvals

Trade Credit Assurance

85% of our awarded applicants are approved!

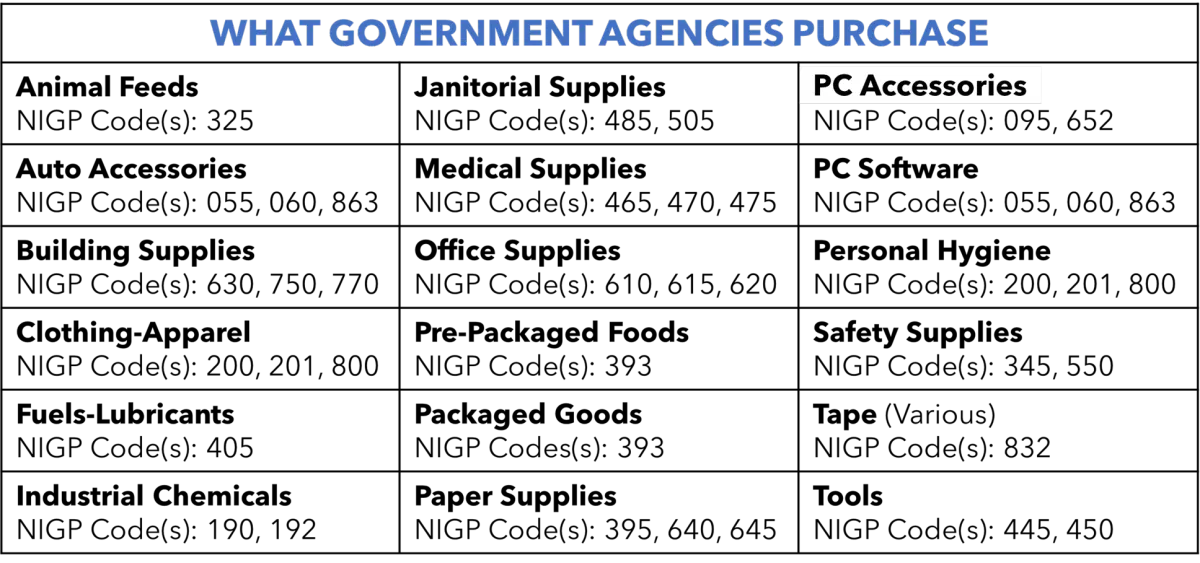

American Credit Assurance, LLC provides Trade Credit Assurance coverage to facilitate sales growth and debt-free working capital for product resellers and participating drop-ship suppliers to deliver on public sector Purchase Orders. Our Credit Assurance helps commercial product resellers build and manage business credit by protecting their suppliers from payment default caused by a failure to pay an invoice through insolvency, refusal to pay, or inability to pay under the credit terms for delivered products.

GOT 5 MINUTES? SEE HOW IT WORKS.

ARE YOU A SALES OR CREDIT MANAGER?

Here's How to Start

If you are actively bidding on government contracts, you will need to demonstrate that your company has the financial capability to fulfill its obligations under the awarded Purchase Order or contract for your products or services. Credit Assurance coverage provides government contractors with access to capital by providing both business credit and a receivable based credit line that can easily increase as your business grows.

PREQUALIFY ONLINE

Start the online prequalification questionnaire and if you qualify, you will receive an email to start your application for a Credit Assurance coverage limit.

GET CREDIT ASSURANCE

If approved, you will receive a 100% "risk free" Term Sheet disclosing all terms, rates, and conditions for your review. You may choose to accept or decline the offer.

SUBMIT TO SUPPLIER

After your coverage is active, you may apply for net credit terms with your suppliers with our insured Standby Letter of Credit as your assurance of payment.

Got Questions? See Our FAQ's!

Didn't find an answer to your question?

WHAT ABOUT MY PERSONAL CREDIT?

Credit Assurance coverage is subject to review of personal credit however, your personal credit score alone will not approve or decline your application for Credit Assurance.

IS CREDIT ASSURANCE CONSIDERED A LOAN?

Credit Assurance is not a loan. Credit Assurance is designed to help build business credit. It is a "debt-free" contract financing solution that combines an insurance backed Standby Letter of Credit together with a receivable based credit line when credit is needed instead of cash to fulfill obligations under a contract.

HOW MUCH DOES CREDIT ASSURANCE COST?

Credit Assurance coverage starts at just $149.95 per month plus applicable transaction fees.

WHY DO I NEED TO BUILD BUSINESS CREDIT?

Startup and growing companies need to build and manage business credit so that the company will have its own credit that is separate and apart from its owners. Financing Purchase Orders and contracts by paying cash upfront can quickly drain bank accounts, inhibit growth, and cause big cash flow problems.

CAN CREDIT ASSURANCE PREPAY MY SUPPLIER?

No. Credit Assurance is designed to help you establish or extend net credit terms with your supplier and will not prepay a supplier on your behalf. Prepaying your supplier upfront does not create a credit transaction between you and your supplier and therefore does not build credit for your business.

COMPANY

CUSTOMER CARE

SUPPLY CHAIN

LEGAL

Copyright 2026. American Credit Assurance. All Rights Reserved.